In today’s economic landscape, many are feeling the weight of rapidly accumulating credit card debt and struggling to keep up with their payments as interest piles on. But they may have a powerful tool to dig themselves out of debt and regain their financial stability – their home equity.

With the median homeowner paying between 6% and 29% interest on a $25,000 balance while holding over $200,000 in tappable equity, a cash-out refinance could be the answer to get back on track financially.

Understanding the Credit Card Crisis

As of the fourth quarter of 2024, Americans collectively owe $1.211 trillion in credit card debt according to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit. The average American carries $6,455 in credit card debt, with interest rates averaging 21.91% on accounts with interest, as reported by Forbes Advisor. This high-interest debt can quickly become overwhelming, but a cash-out refinance can provide the funds necessary to alleviate the burden.

What is a Cash-Out Refinance?

What is a Cash-Out Refinance?

A cash-out refinance allows homeowners to tap into their home’s equity and refinance their existing mortgage for more than they currently owe, receiving the difference in cash. This can be a powerful tool to access funds and consolidate high-interest credit card debt into a single, lower-interest loan.

How a Cash-Out Refinance Can Help

How a Cash-Out Refinance Can Help

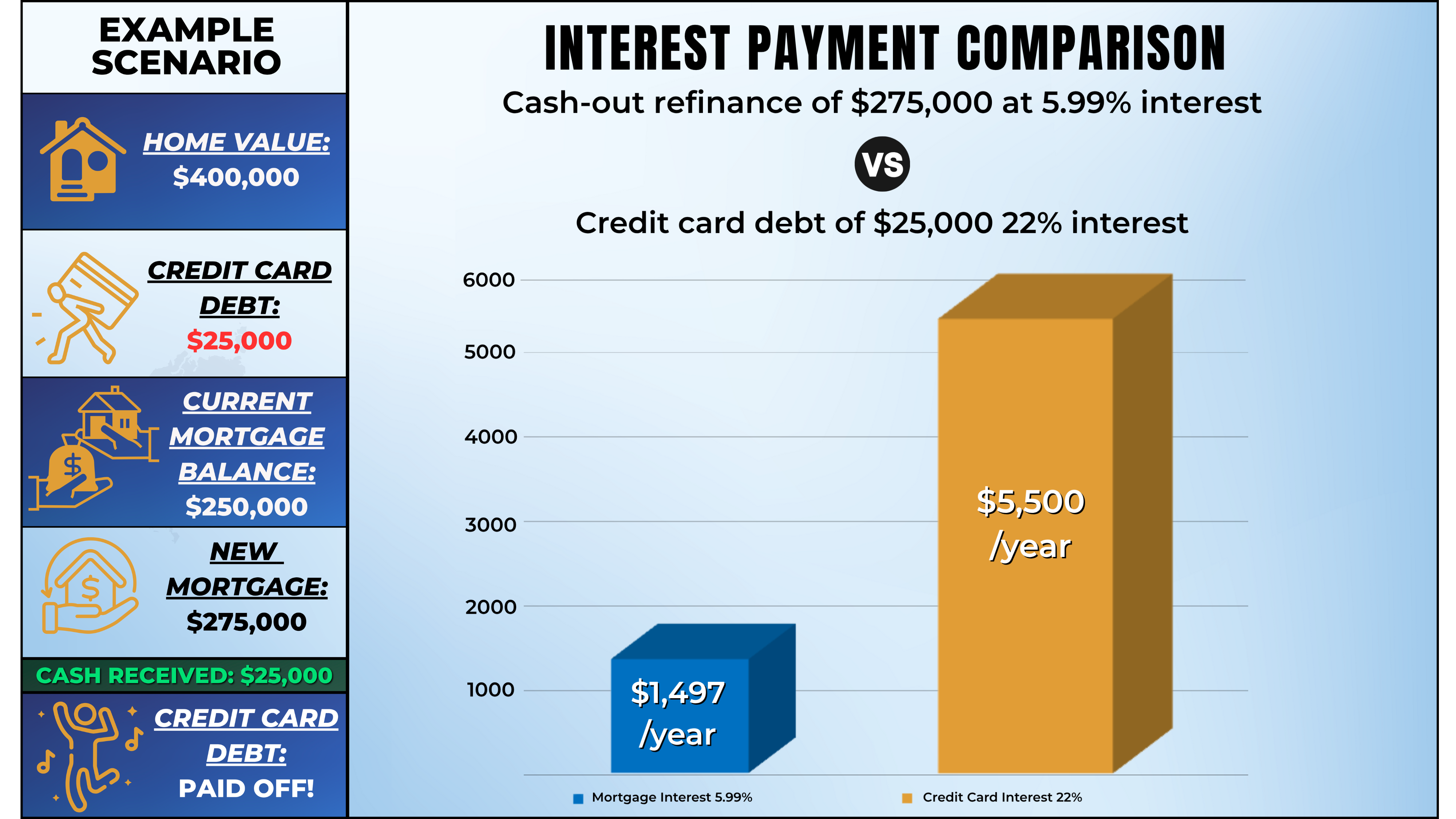

It’s important to note that mortgage interest rates are much lower than credit card interest rates. By getting a cash-out refinance, homeowners can use that cash to pay off their credit card debt and greatly reduce the amount of interest they pay as a result.

For example, turning $25,000 in credit card debt at 22% interest into a $275,000 mortgage at 5.99% (through a cash-out refi) can reduce annual interest from $5,500 to approximately $1,497. That’s over $4,000 in savings per year!

Additional Benefits

Additional Benefits

Lower interest rates mean lower monthly payments, freeing up cash for other expenses or savings. Furthermore, consolidating multiple credit card debt payments into a single mortgage payment makes it easier to budget, and it reduces the risk of missed payments.

Is Cash-Out Refinancing Right for You?

Is Cash-Out Refinancing Right for You?

Cash-out refinancing offers many benefits, so take the time to evaluate your current mortgage terms, the amount of equity available to utilize for the refinance, and your long-term goals. If you’re interested, AmeriHome Mortgage offers a cash-out refinance loan that may be the perfect option for you.

Looking to start your journey to a new home? The options and benefits available may surprise you!

Get Started Today With:

![]() Various Loan Options

Various Loan Options

Find a better home loan for your unique goals and financial situation.

Expert Guidance

Expert Guidance

Our Home Loan Experts are here to help by sharing their knowledge and setting you up for a successful process from application to close, throughout the life of your loan, and well into the future as your trusted partners.

Pre-Approval

Pre-Approval

Before you have found your dream home, get pre-approved for FREE. Once all information is submitted, we will provide your pre-approval details within the next business day.

Mortgage Checkups

Mortgage Checkups

Monitor and update your home loan as your mortgage needs and goals may change over time.

After you have financed a home with us once, save up to $750 on all your future refinances and new home purchase loans with your AmeriWallet Benefits.*

After you have financed a home with us once, save up to $750 on all your future refinances and new home purchase loans with your AmeriWallet Benefits.*

We can help guide you through every step of the home financing process. To get started, just give us a call at 877.785.5422 or get your rate quote here.

Just Imagine The Possibilities…

*As a member of the AmeriHome family, borrowers are part of the AmeriWallet Rewards program. If you completed a home loan with us once, you will qualify for a $750 lender credit for all of your future refinances or home purchases done with AmeriHome, for any property you own. To qualify for this offer, you must have previously financed the purchase of a home or refinanced with AmeriHome. You have financed with AmeriHome when AmeriHome Mortgage Company, LLC appears on the previous Promissory Note for your loan, and you are listed as a borrower on the Note. Credits will be applied only if your loan closes with AmeriHome. This offer can not be combined with any other offers and is not applicable for FHA Streamline, or VA IRRRL Refinance transactions. Other restrictions may apply. Terms and conditions are subject to change. AmeriWallet Rewards program is subject to termination without notice.